How Zomato is spreading

From an eating joint that sought to solve a 'hunger' problem to becoming a huge Indian multinational restaurant aggregator and food delivery company Zomato's growth story is not only a perfect example of Atmanirbhar Bharat but also its young startups. And not to forget that Zomato broke the norms of how traditional India consumed their food.

Deepinder Goyal and Pankaj Chaddah were IIT Delhi graduates who worked for Bain & Company in New Delhi. During that time an idea struck them as to how to save time and make it easy for people to access food. This is how 'Foodiebay' was established in 2008.

FoodieBay became the largest restaurant directory in Delhi NCR and its operations were later expanded to Mumbai and Kolkata. After two successful years, the company was rebranded as Zomato and since then there was no looking back. Every year the number of app users has increased steadily.

The increase in the number of users led the duo to extend it internationally and as a result of this Foodiebay was renamed Zomato on January 18, 2010.

Zomato is an Indian multinational restaurant aggregator and food delivery company founded by Deepinder Goyal and Pankaj Chaddah 2008. Zomato provides information, menus, and user reviews of restaurants as well as food delivery options from partner restaurants in select cities.[9] As of 2019, the service is available in 24 countries and in more than 10,000 cities.majority of funding in food delivery is concentrated on Swiggy and Zomato, which prompts analysts and investors to suggest that the Indian food tech market is effectively a duopoly. But as seen in recent developments, Swiggy and Zomato have latched onto divergent business strategies.

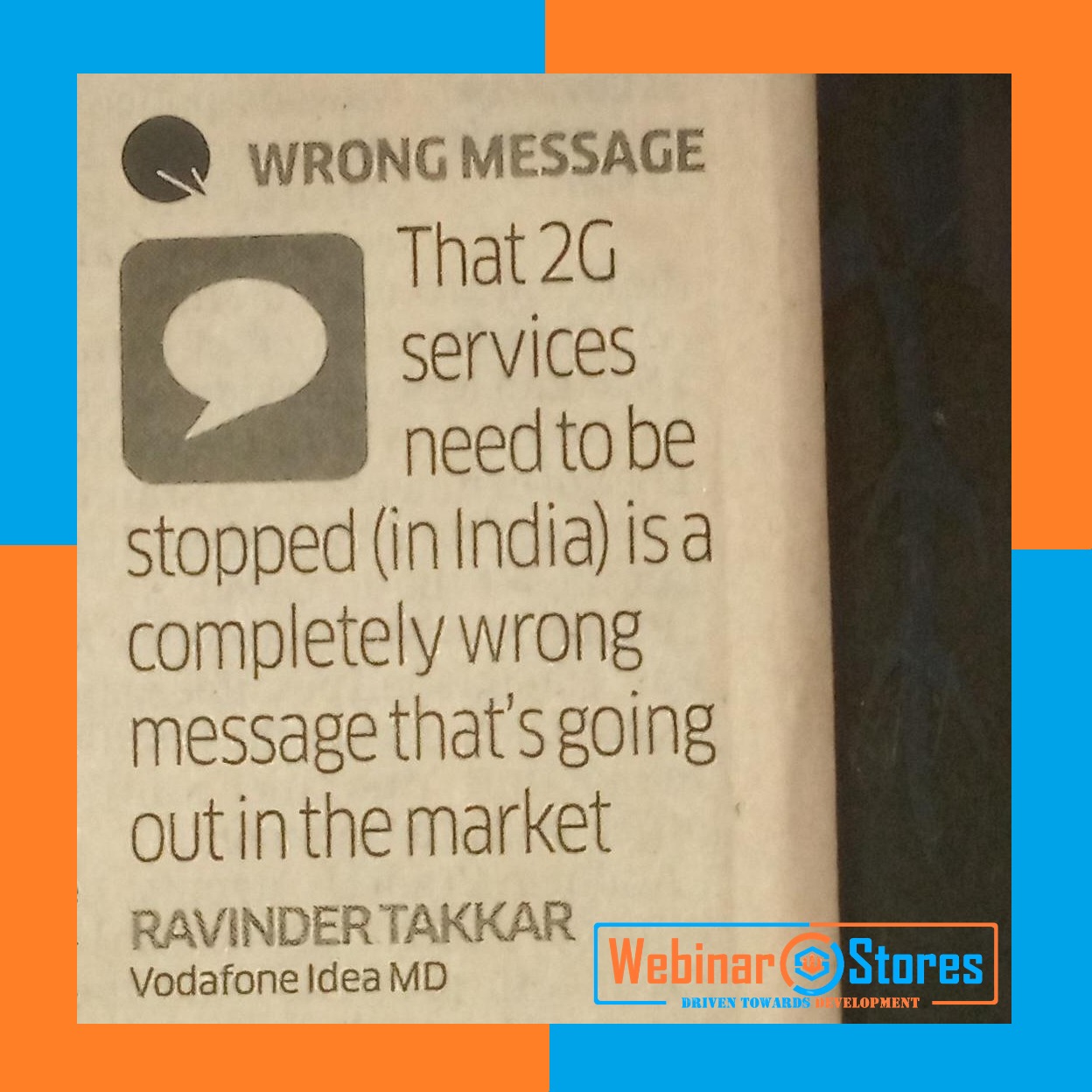

“We think (that) food delivery industry has attained a decent equilibrium now in terms of competition and is basically a duopoly market. There’s little reason for Swiggy to significantly undercut Zomato. This follows the global pattern with 2-3 players enjoying healthy growth,” a February 2021 HSBC report on India’s consumer internet market says. The report also pointed out that food tech currently handles annual GMV worth $2.5-3Bn in 2021, with an opportunity to cross $16Bn in annualized GMV by 2025.

Karan Sharma, Executive Director, of investment baking firm Avendus Capital, also agrees that the food delivery market is almost now like a duopoly market, where both Swiggy and Zomato will continue to operate as independent aggregators. Since India has a large localized supply of restaurants that is yet to move online, food delivery will remain a core service for both Swiggy and Zomato. “And for someone like Dunzo, I think they will keep on refining the category mix and value proposition, and they won’t compete directly on food delivery, with these two giants. I think they will keep diversifying into more and more spaces, and new towns,” adds Sharma.

So, for many experts and analysts, the big question is whether the Indian food tech market has the potential to generate more billion-dollar startups? This is where Dunzo comes in because a duopoly perhaps is not up to the task of serving the varying needs and demands of a multicultural nation.

A typical super app in the delivery and commerce space offers everything from food delivery, ride-sharing, movie and travel ticketing, home services, payments, lifestyle services, and more. The two survivors of the food tech story in India — Swiggy and Zomato — now find themselves in a less competitive market, but with very little scope for improved monetization in food delivery. So the next five years for food tech in India will be about how players revamp themselves, reimagine their models, and utilize their last-mile network to capture a bigger piece of the pie.

Note:- For All News & Blogs, Kindly subscribe to us. Your Comment would guide us to your preferences.

1.jpg)

(4) Comments

Greg Christman

Excellent course!

Rimply dummy text of the printinwhen an unknown printer took eype and scramb relofeletogimply dummy and typesetting industry.

Lora Ekram

Excellent course!

Rimply dummy text of the printinwhen an unknown printer took eype and scramb relofeletogimply dummy and typesetting industry.

Mike Jones

Excellent course!

Rimply dummy text of the printinwhen an unknown printer took eype and scramb relofeletogimply dummy and typesetting industry.